ROXY-PACIFIC HOLDINGS PTE LTD

Roxy-Pacific Holdings Pte Ltd (“Roxy-Pacific” or the “Group”) is an established property and hospitality group with a track record dating back to 1967. Armed with more than 50 years of experience and expertise, the Group is primarily engaged in the development and sale of residential and commercial properties, property investments and hospitality operations in key locations across the Asia-Pacific region.

The Group’s residential development projects typically comprise of small-to-medium sized residential developments such as apartments and condominiums. Between 2004 and 2022 the Group developed and launched more than 60 developments comprising a total of more than 5,000 residential and commercial units in Singapore, Malaysia and Australia.

Grand Mercure Singapore Roxy, a major asset of the Group, is self-managed under franchise agreement with international hotel operator, Accor Group. Beyond Singapore, the Group operates three hotels under its brand, Noku Roxy. These includes two boutique hotels in Kyoto and Osaka, Japan, as well as resorts in the Maldives (managed by IHG under the Vignette collection brand) and Phuket. The Group has also purchased its first service apartment at 12onshan, Singapore, which is currently managed by Momentus Hotels and Resorts.

In terms of property investments, the Group owns 56 retail shops at Roxy Square Shopping Centre in Singapore. In Melbourne, Australia, the Group owns a 45% interest in a commercial building at 312 St Kilda Road and a 40% interest in a commercial tower located at 350 Queen Street. Additionally, the Group owns a 40% interest in a commercial building at 33 Argyle Street and a 100% interest in 165 Walker Street, Sydney. In Auckland, the Group owns NZI Centre and has a 50% interest in an office building at 205 Queen Street.

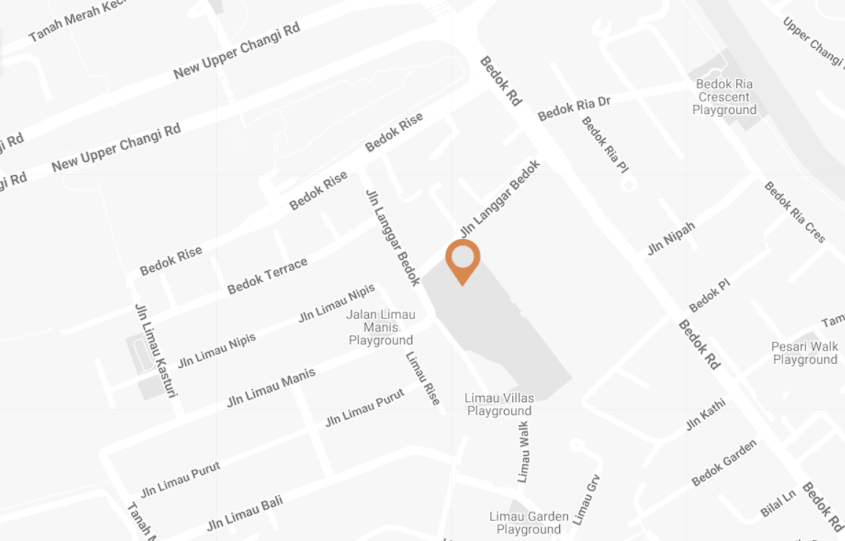

Developer: RL Bagnall Pte. Ltd. | Company Registration Number: 202301443W | Developer’s Licence No.: C1504 | Tenure of Land: Estate in fee simple | Encumbrances: Mortgage(s) / Deed(s) of assignment and mortgage(s)-in-escrow in favour of Hong Leong Finance Limited | Location: Lot 07390X, 07391L PT, 10348K PT of MK 27 at Upper East Coast Road | Expected Date of Vacant Possession: 31 December 2028 | Expected Date of Legal Completion: 31 December 2031

MORI

SLB DEVELOPMENT LTD

30/31 NORTH CANAL ROAD

KSH HOLDINGS LIMITED

KSH Holdings Limited (“KSH”, or “Group”) is a long-standing construction, real estate development and investment corporation with more than 40 years of experience, listed on the SGX-ST Mainboard since 2007. Backed by a strong and diversified track record, the Group boasts a wide range of construction and real estate projects across various sectors both locally and abroad, with a geographical presence in Singapore, United Kingdom, Australia, Japan, Malaysia and China.

KSH is a main contractor for both public and private sectors. With a Grade A1 rating under BCA CW01, it is capable of bidding for Public Sector construction projects of unlimited value. The group is also rated A2 under BCA’s CW02 for civil works. KSH has won several BCA Construction Excellence Awards for projects including Fullerton Bay Hotel, NUS University Town’s Education Resource Centre, Madison Residences, Mount Alvernia Hospital etc. In 2019, it received BCA Construction Excellence Award (Excellence) for NUS University Sports Centre and Construction Excellence Award (Merit) for Heartbeat @ Bedok.

Through strategic alliances and joint ventures, KSH’s property development and investment presence spans across various real estate sectors including residential, commercial, hospitality, and mixed-use developments. Apart from having successfully executed residential and mixed-use development projects in Singapore and China, the Group has jointly acquired properties in other geographies including the United Kingdom, Australia, Malaysia and Japan. It will continue to explore opportunities in new markets with a focus on Southeast Asia.

While the Group is actively involved in major residential developments in Singapore with joint-venture partners, KSH has successfully delivered residential, mixed development, office and commercial in Singapore including Riverfront Residences, Rezi 24, High Park Residences, Affinity@Serangoon, Park Colonial, Sky Green, Trio, The Boutiq, NEWest and Hexacube etc. Meanwhile, The Arcady at Boon Keng was launched in Jan 2024, sora at Yuan Ching Road and the mixed development of One Sophia / The Collective at One Sophia are among other new launches.

Other real estate developments in China include the completed Liang Jind Mind Ju (有表景明居 Phase 1 2 and 3), and Sequoia Mansion (紅衫公館) in Beijing; and the ongoing projects of Sino Singapore Health Citu. Zhong Xin Yue Lang (中新健康城 . 中新悅朗) and Zhong Xin Yue Shang (中新悅上) in Gaobeidian.

On the Property Investment front, the Group invests in yield-accretive assets that generate a sustainable stream of income with potential capital gains. These include a 36-Storey retail and office complex, Tianjin Tianxing Riverfront Square, in the heart of the business district of Tianjin, China.

The Group seeks to continue broadening its businesses and projects, and explore opportunities in new markets while striving towards sustainable growth to enhance shareholder value.

THE ARCADY AT BOON KENG

H10 HOLDINGS PTE LTD, HO LEE GROUP

OLA

FT DEVELOPMENT PTE LTD, LJHB HOLDINGS

PULLMAN MALDIVES MAAMUTAA RESORT